Building Event-Driven Banking as a Service (BaaS) with NATS

The banking industry has spent years layering APIs on top of legacy systems to modernize customer experiences. That work has enabled Banking as a Service (BaaS) — a model that lets banks, fintechs, and partners securely expose core capabilities through APIs. But as expectations for real-time, intelligent, and personalized interactions grow, the traditional API-led model is beginning to show its limits.

To meet the next wave of digital banking innovation, financial institutions need to evolve beyond static API meshes and embrace event-driven architectures. And in that transition, NATS is emerging as a powerful enabler.

From API-Led Banking to Event-Led Banking

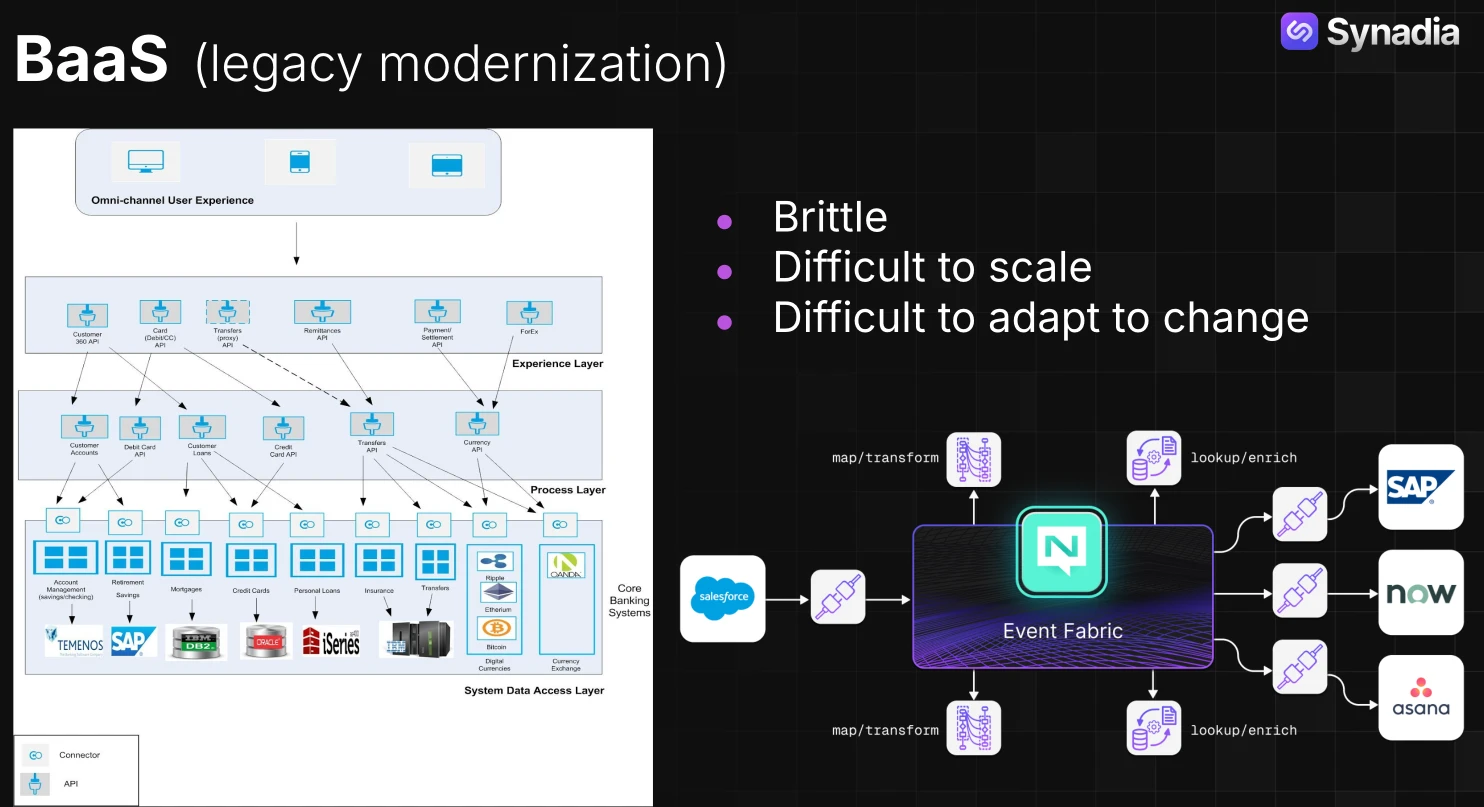

Let’s start with how BaaS architectures are typically built today. Most follow an API-led connectivity model, popularized by MuleSoft and others. It’s organized into three logical layers:

- System APIs connect to systems of record — the core banking platforms, payment processors, and data stores.

- Process APIs orchestrate business logic — for example, combining multiple systems to build a “Customer 360” or “Payments Hub.”

- Experience APIs present those capabilities to the outside world — mobile apps, web portals, or partner integrations.

Each layer abstracts complexity and focuses on a specific function. It’s a sound pattern, and it’s helped banks safely expose internal systems to modern channels.

But there’s a catch: this approach is inherently synchronous and tightly coupled. Each layer depends on the one below it, and every request must complete before the next begins. That works for simple transactions, but it doesn’t scale well in a world that’s increasingly real-time and event-driven.

Where Traditional BaaS Falls Short

Modern banking isn’t just about responding to API calls. It’s about reacting to events — a transaction posting, a balance threshold being crossed, a card being swiped overseas, or a fraud alert being triggered.

Traditional APIs weren’t built for that. They’re great for retrieving data on demand but not for broadcasting and reacting to changes as they happen.

That leads to several challenges:

- Limited real-time interaction: APIs can’t easily push notifications, alerts, or offers without additional messaging infrastructure.

- Dependency chains: The more APIs you stack together, the more fragile the system becomes. A failure or delay in one can cascade through the rest.

- Scaling complexity: You can’t easily scale individual components independently because of the synchronous coupling between layers.

To truly support modern digital experiences — and to prepare for what’s next — banks need a more asynchronous, event-centric approach.

Flipping the Model: Event Core First

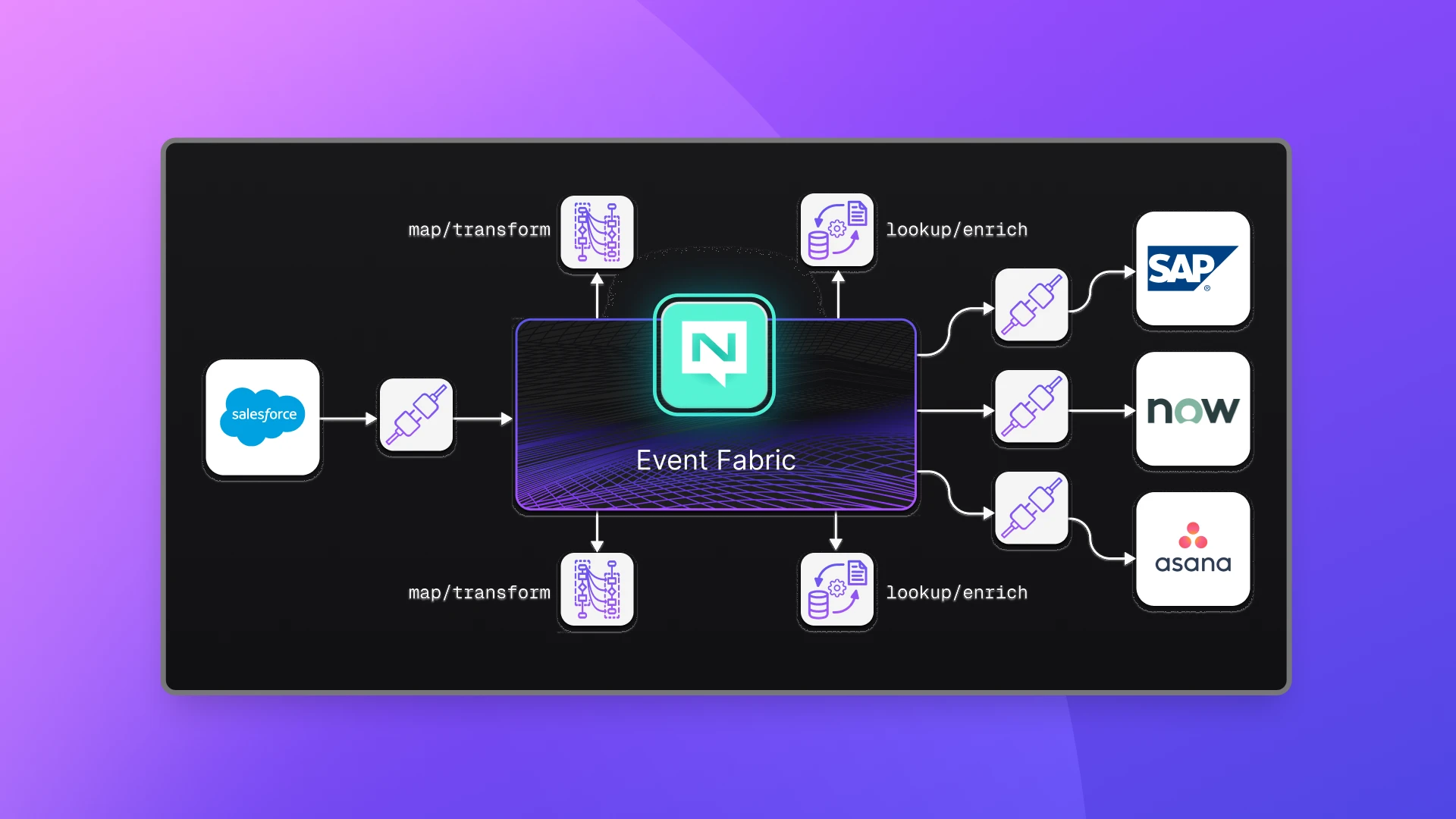

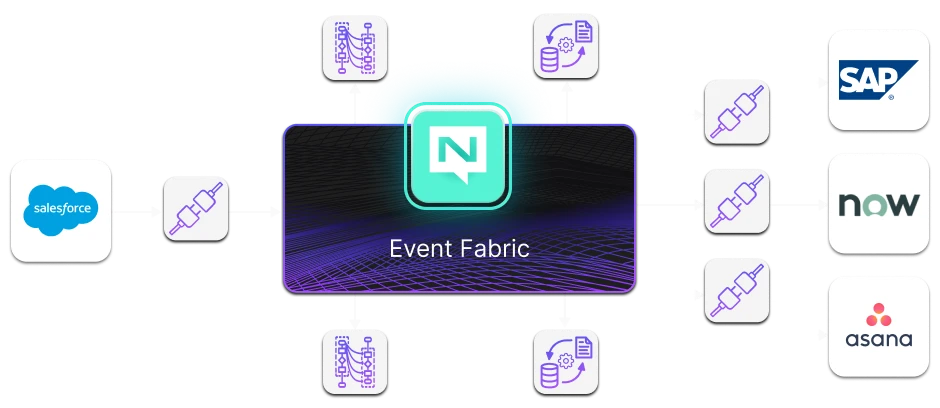

Imagine taking that familiar three-layer BaaS model and flipping it on its head. Instead of chaining API calls, you place an event fabric at the core of the architecture.

Each service — whether it’s a payments processor, fraud detection engine, or customer notification service — becomes a publisher or subscriber on that fabric. APIs still exist, but they become edges of the system rather than its core.

This is the event-driven Banking as a Service model:

- Events replace direct calls: Services emit events like

payment.completed,account.updated, orkyc.verifiedonto the event fabric. - Subscribers react asynchronously: Other services listen for those events and act independently.

- Everything decouples: Failures, updates, and scaling happen locally without rippling across the entire system.

The result? A more flexible, resilient, and scalable banking architecture that’s ready for the cloud, the edge, and future digital channels.

Why NATS Is the Perfect Fit for Event-Driven BaaS

If you’re moving toward an event-driven architecture, the next question is: Why NATS?

While other systems offer pieces of the puzzle, NATS uniquely combines eventing, streaming, and simplicity in one platform. Here’s how that plays out for Banking as a Service.

1. Unified Eventing and Streaming

In most enterprise stacks, event routing and streaming are handled by different products — IBM MQ or Solace for messaging, Kafka for streaming.

NATS brings both capabilities together:

- NATS Core for lightweight, low-latency pub/sub eventing.

- JetStream for durable streaming, replay, and persistence.

With NATS Core you get fire-and-forget ultra-low-latency delivery; JetStream adds optional durability for at-least-once or exactly-once semantics. That unification means fewer moving parts, lower latency, and less operational overhead.

2. Cloud, Edge, and Hybrid Simplicity

Banking workloads are inherently hybrid — core systems on-prem, digital services in the cloud, and edge endpoints like ATMs or kiosks.

With NATS, you can form a single supercluster that spans all of them.

Events flow seamlessly across environments without specialized gateways or custom bridges. Whether your systems run in a data center, AWS, or at the branch edge, they all share one event fabric.

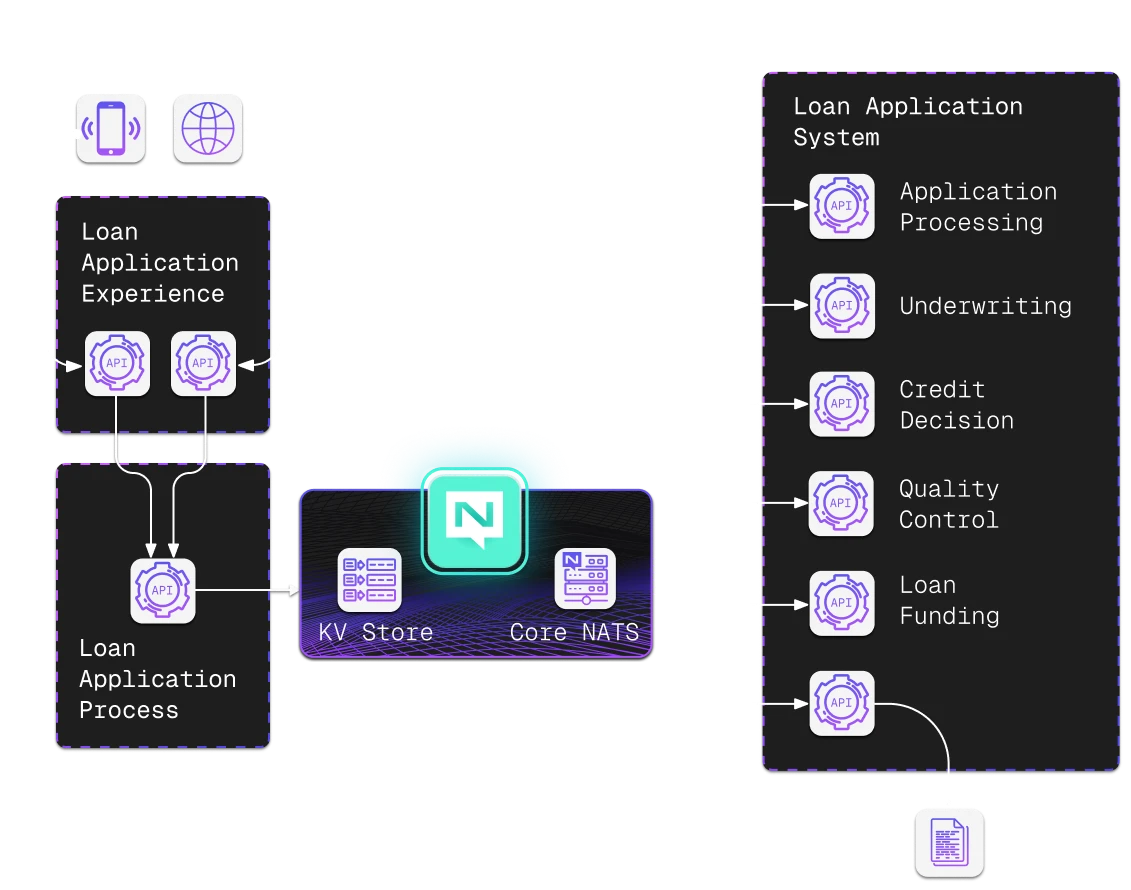

3. Built-in State Management

Long-running workflows — like loan processing or customer onboarding — require maintaining state between events. Most event platforms rely entirely on external caches or databases for this.

NATS JetStream’s Key-Value and Object Stores can natively persist workflow state and metadata, reducing the need for separate caching layers — though they complement, rather than fully replace, transactional databases.

4. Linear Scalability Without Extra Infrastructure

NATS scales horizontally by design. Its distributed cluster architecture and RAFT-based consensus let JetStream scale horizontally within its clustered architecture — without requiring external load balancers or complex routing layers.

That simplicity translates to less complexity, lower latency, and more predictable performance as workloads grow.

5. Built-in Security for Regulated Environments

Financial systems demand not just speed but absolute trust. NATS provides enterprise-grade security with built-in TLS and mutual TLS (mTLS), nkey-based authentication, and fine-grained authorization via accounts and leaf nodes.

This design isolates tenants, enforces zero-trust communication, and ensures no system component ever has access to private keys or passwords.

Such capabilities make NATS a natural fit for regulated industries like banking and fintech, where data privacy and compliance are paramount.

The Future of Banking Is Event-Driven

APIs will always be part of modern banking, but they’re no longer enough on their own. Real-time finance demands a backbone built on events — fast, asynchronous, and distributed by design.

By adopting an event-driven core, banks and fintechs gain the agility to integrate new services, partners, and technologies without rearchitecting their entire stack.

And with NATS, they get a unified, cloud-native platform to make it happen — one that brings together eventing, streaming, and state management in a single, lightweight system.

The result: A more connected, resilient, and responsive foundation for Banking as a Service — built to handle whatever the next wave of digital finance brings.

Watch this webinar for more on NATS in Financial Services.

Start building with NATS today

NATS is available as open source through NATS.io, and Synadia provides enterprise-grade support through Synadia Platform for on-premises and private cloud deployments, and Synadia Cloud for teams getting started with fully managed NATS infrastructure.

With Synadia Cloud, you get built-in monitoring and management through our Control Plane UI, so you can focus on building event-driven architectures instead of managing servers.

Start with Synadia Cloud for free or explore Synadia Platform for single-tenant deployments.